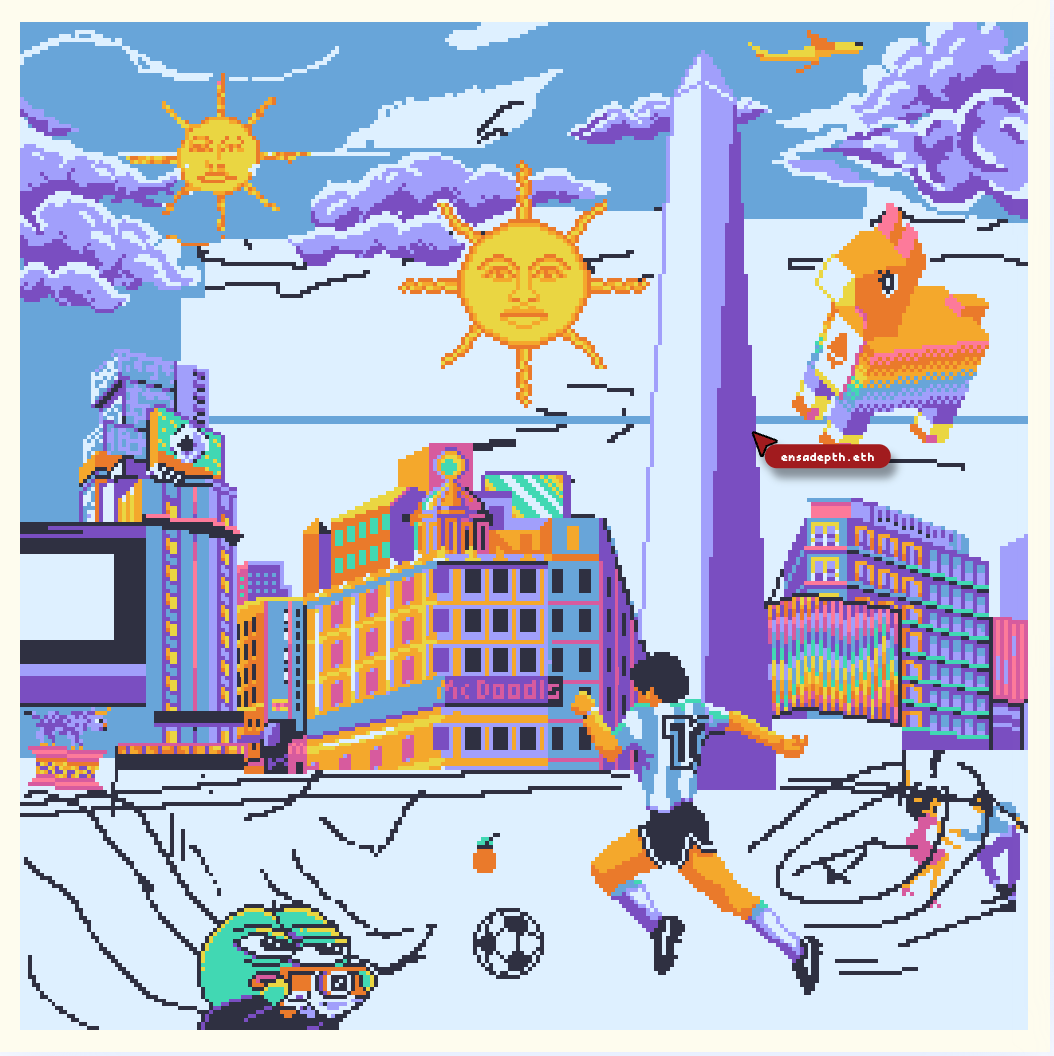

In less than a month, Devconnect, "the first Ethereum World's Fair", will take place in Argentina, with its epicenter at La Rural, Buenos Aires's main convention center. Organized by the Ethereum Foundation, from November 17–22, it will bring together leading teams and organizations from across the ecosystem to help shape the network's future.

The choice of Argentina is no coincidence, given that Buenos Aires has one of the densest clusters of Ethereum infrastructure teams, active since the network's early days. From cryptography-, zero-knowledge-, and L2-focused groups such as LambdaClass and Wonderland.xyz, to leading smart-contract auditor, OpenZeppelin. In addition to projects like MakerDAO (now Sky.money), which created DAI, an early non-custodial dollar-pegged stablecoin; as well as regional wallets with millions of users, such as Lemon and Ripio.

Although Argentina has one of the most credible development communities within the Ethereum ecosystem, this year it made headlines not for its virtues but for its vices. The "Libra" token scam (unrelated to Facebook's former Libra project), publicly amplified by President Javier Milei, not only harmed victims; it also damaged the reputation of the local developer community –hard-won over years of infrastructure work and innovation– at the hands of a two-bit con man like Hayden Davis. Argentina, as we see, is a complex country, with a somewhat contradictory history.

That may be the very damage Devconnect aims to repair, while also bringing the local community closer to the broader public. Just as Javier Milei demonstrated a broad lack of knowledge of the serious universe of cryptocurrencies, the rest of the political spectrum is not far behind. Different expressions that range from techno-optimistic approaches, where hand-wavy silver-bullet solutions to specific problems are sold, to technophobic takes that lump the entire development of Bitcoin and Ethereum together with scams like Zoe Cash. The ability to discern between both poles of the spectrum was always key, but now it is more so than ever.

Metaphysics on the Blockchain

Now, it is also true that the crypto ecosystem was never a completely simple place for newcomers. This ambivalent nature of Argentina also manifests itself as a major internal divide within the crypto ecosystem, and Ethereum is not exception. There is a culture war going on. Although many devs would have liked otherwise, these scenarios are inevitable.

Where there are human beings building things, there are sides. There are opposing views and these differences are not trivial, since they are what set the course of a project. When there is so much money at stake, those differences can mutate into trenches. Despite the techno-optimistic dream that technology would have solved politics' problem, politics always manages to re-enter through the window once it is thrown out the door. As those of us who are interested in this fine art know, the master algorithm of politics is loyalty –and it may be the only thing that counts when sides dig trenches.

Even extrapolating this criterion to the blockchain architecture itself, what is a hard fork if not a break –a cultural schism– within the community? Isn't it a break in loyalty to one's own project? But I don't want to go off on a tangent on metaphysics, something that I really like a lot but is material for another article.

Cryptopunks vs the Managerial Class

Let's lower it to something very specific. Anyone who has spent enough time meeting people, companies, and development groups in crypto can typify two human types. The first is neither more nor less than the cryptopunk. Cryptopunks are easy to identify. They tend to dress casually, care little about appearances, and are disarmingly blunt and they can quickly start talking about at least one topic within the wide range that constitutes the geek culture: science fiction, Warhammer, Magic: The Gathering, Argentum, Age of Empires, StarCraft, some role-playing game, specific movie genres, Akira, Ghost in the Shell, a favorite Torrent client or a self-hosted server. Although also some kind of deep knowledge regarding economics, engineering, mathematics, algebra, logic and, of course, programming languages. Everyone owns a Raspberry Pi. It is very easy to know that everyone has a position regarding who made up "Satoshi Nakamoto" and everyone gets excited when you talk to them about Hal Finney. Cryptopunk or crypto nerd entered technology because there they found something that was not available anywhere else in the world. Fundamentally, something related to security, with anonymity, with the possibility of moving money outside the banking system, and with the philosophical foundations explained in Satoshi Nakamoto's whitepaper. The crypto nerd is a spectacular human being. He doesn't care what people will say, he could spend all day in flip-flops with socks and tried at least two hardware wallets (or other cold-storage setups).

On the other hand, there is a second human type: management o managerial class. This group has no intrinsic interest in crypto, nor in Bitcoin, nor in the advancement that a smart contract implies. The management class is in crypto, as it can be in the banking world, in energy, in sports, in an airline. It's here because it is a legitimate way to make money, develop a network of contacts with more or less important people and at the same time develop your own "career". The management class appears when an ecosystem begins to consolidate and, necessarily, it establish ties with the legacy world. This happened when crypto, through centralized wallets and brokers such as Binance, Coinbase, Kraken and even FTX, had to start weaving relationships with the traditional banking world. In general, they wear a jacket or dress in a suit. In the crypto world there are a few recurring red flags. This spectrum is made up, for the most part, of lawyers, quick money seekers (gold diggers), projects that sell totally useless tokens but disguised under a "serious" suit to catch the unsuspecting, companies that provide solutions to problems that do not exist (I remember one that wanted to tokenize cows), some simply scammers and others that gather around perpetual coffee-meetup culture, or coworking spaces that are nothing more than honeypots for unsuspecting visitors or digital nomads.

If someone has a suit and wants to convince you to buy the token for their "serious" project, they are possibly a scammer. The same thing happens with environments, meetings or coworking spaces where the only thing you find is small-time lawyers and lobbyists selling excessive optimism for technologies they barely understand. As a general rule, if I see someone in a suit talking to me about crypto, I watch my wallet. On the other hand, and as a general rule, with everyone who has some type of belonging to "the spectrum" I feel a quasi-automatic trust. So far, that instinct hasn't failed me.

If a project cannot be explained simply, if it is not possible to understand what it does, how it does it, why it does it, if that project does not have a use case or has no value within the community, the best thing is to run away.

Emerging Use Cases on Ethereum

The arrival of Devconnect is also a good time to see what Ethereum is up to after some fundamental changes to the way it processes payments, becomes more secure, and increases its decentralization capabilities.

Ethereum is undoubtedly one of the main crypto projects on the planet, given its track record of constant innovation. Since the creation and actual implementation of the concept of "smart contract", the notion of a global computer has occupied a central place in its ethos. Then came successive waves of hype where it always seemed to be close to finding a definitive use case that would facilitate mass adoption by the general public: from the ICO era and CryptoKitties to the NFT boom, the rise of DeFi, the metaverse wave, and beyond, where each one left their own.

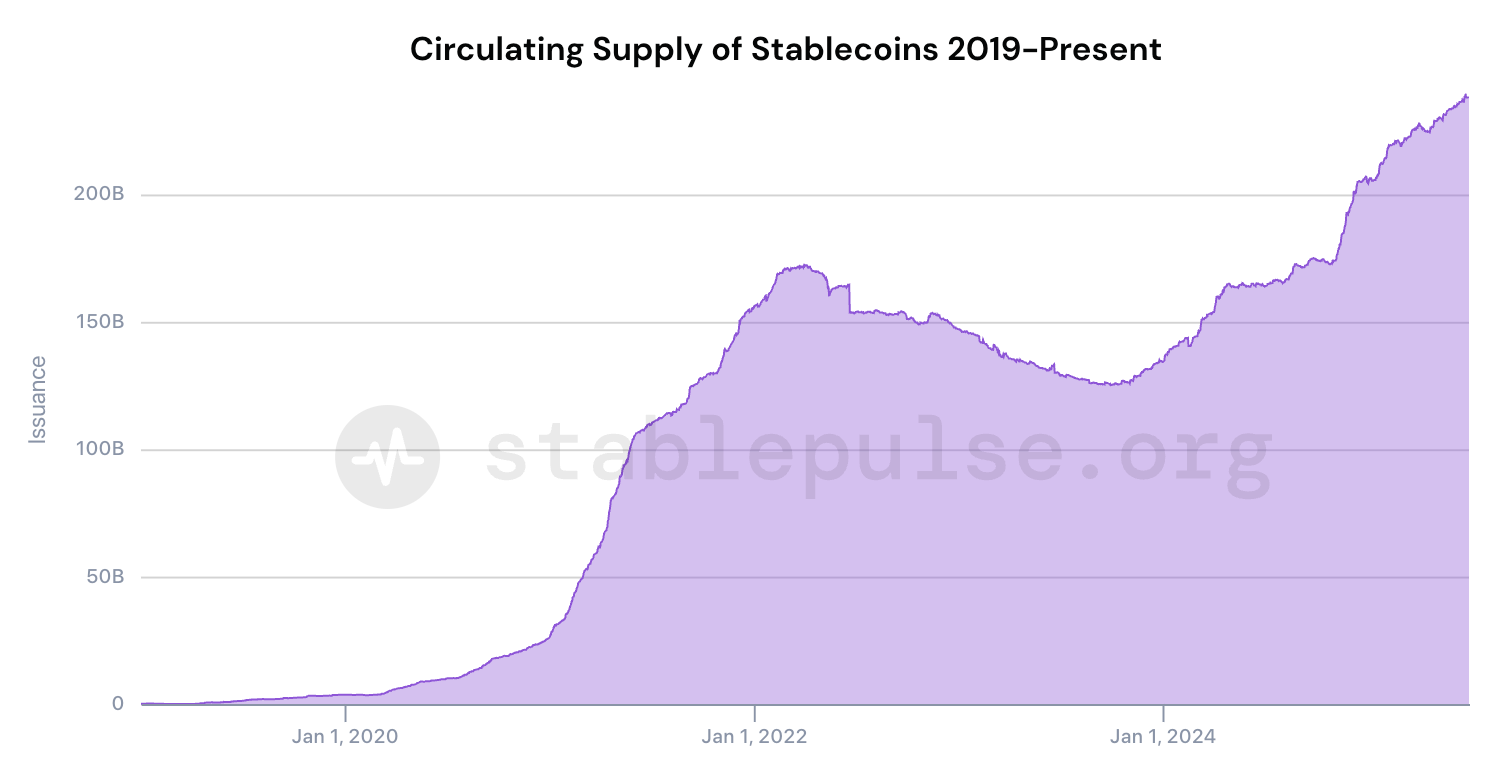

Each wave had its expansion, its explosion and then its obvious exhaustion. However, things remained in that process. In parallel, Ethereum became the leading platform for stablecoins. From 2020 to now, this market grew exponentially, reaching 200 billion dollars nowadays.

In short, and behind each wave that arose in the heat of the possible innovations that the platform's technology allowed, what was happening is that Ethereum found its own use case based on the needs of its users. At some point, served as a laboratory for innovation –and that approach has worked. Meeting a particular use case can mark a turning point for the entire Ethereum community.

As explained in a post by Electric Capital, Ethereum became a quasi-banking stack for the global un- and underbanked majority around the world. Of course, a use case that may seem somewhat absurd in the main economies, but for countries with very poor banking infrastructure like Argentina or other low- and middle-income countries it is a kind of oasis. The ability to buy and sell dollars without restriction, to send international payments in seconds at low cost and even to be able to access credit with those digital dollars opens the possibility of having a banking system, quite decentralized, as neutral as such a tool allows, whose horizon is the global integration of payment rails.

Vitalik Buterin, the main reference for Ethereum, has proposed something along these lines in recent posts on his personal blog. And is something that can undoubtedly become one of the most important key topics of discussion in the Devconnect 2025, especially in a context as convulsed regarding the entry of dollars, bailouts and failed stabilization plans as the Argentine one. In fact, Vitalik himself is confirmed to attend the fair.

What Buterin proposes is the possibility that Ethereum will finally find a use case that is the core of the network business. That is, a use case so large that it allows constant growth in users and revenue for validators who have their capital invested in ETH and its validation processes. Buterin proposes or analyzes the possibility that a system that pays a low rate at very little risk to stablecoin holders on Ethereum could be the long-sought killer use case that definitively turns Ethereum into a global platform for mass adoption.

If you think about it, it would simply be replicating a quasi-standard banking model in which the network would offer a yield of around 5% to those who leave their tokens held on-chain. The big difference is that it would be a kind of decentralized bank with the possibility of serve users globally, beyond any single jurisdiction. Although this perspective also has its own drawbacks, it would undoubtedly be a definitive leap on the network's path to becoming what it always aspired to be: the infrastructure of a new global financial system.

And there, then, as we explained above, the internal struggles for the spirit and control of the project gain another level of relevance. Both at the micro-Argentine level, to which we dedicate a good space in this article, and at the international level, where although there is another level of complexity, in general terms the fight is the same: cryptopunks against managers. Which is nothing more than the fight for the spirit of the times manifesting itself in a technical dispute on a global scale. See you in the trenches.