There are things you fear because you know you'll like them. And a lot. My two main ones are the merca and the timba. They look quite like: emotional intensity, speed, feeling of knowing everything, of being able to do it all. The combo financialization-flow management increasingly takes share of social activity and competes with the large structures of the twentieth century – such as school, army or prison, replaced by continuing education, mercenaries or home prison – or replaces other mechanisms of social coordination. Meanwhile, we started betting on the future but not as in a horse race, but as in a universal stock market.

The Wheel of Fortune (what a pingo is Polymarket)

Polymarket is a crypto platform where you can buy shares of giant bets for future events. How is silver made in Polymarket? Having reason about the outcome of an event: who will be the next president of Chile, on a case. But trading can also be done by taking advantage of fluctuations in market perception.

That is, I can buy "No" to the end of the war in Ukraine this year when it is worth very little and sell it if in two weeks something happens that makes it a more plausible option. Prices range from $0 to $1, implying the odds of the event occurring (according to market opinion, of course). When the bet is resolved, the winners receive one dollar per share. That is, if you bought "No" at 0.20 USDC, you gain 0.80 USDC.

Crypto and venture capital Titans, such as Vitalik Buterin and Peter Thiel, have invested in this platform, which today suffers restrictions to operate in the United States but remains, possibly, the most popular prediction market in the world. There is everything: politics and economics – what tempts me more – but also culture, sports or technology. We are not all experts in something, but there are issues that we follow more and that makes one tempt.

Postmodern investments

In 1990, Gilles Deleuze published Postata to control societies, where he developed a synthesis of what he considers a new model of society, the successor of the society of Foucaultian discipline. Since the middle of the 20th century, confinement structures, oriented to organize production, would be collapsing: the army, schools, even the family. What remains are "ultra-fast forms of outdoor control".

I keep quoting:

While the different control apparatuses are inseparable variations, they form a variable geometry system whose language is numerical (which does not necessarily mean binary). Enclosures are molds, different modules, but the controls are modulations, such as a self-deforming mold that would change continuously, from one moment to the other, or like a sieve whose mesh would change from one point to the other.

Control replaces the confinement with continuous variation. The coins, before gold, are now a series of floats. Everything becomes a stock and the future – in the most essential sense of the word – before a program, a conquest or an invention, is another asset that must be administered.

The individual becomes a figure – a token on the Ethereum blockchain, via Polygon, if we go to the case of Polymarket – a data cluster that operates in the gigantic network of a company turn company and market. He is no longer a worker in the modern sense (part of a production cycle by which he obtains a wage, and so) but is an investor of his own labor force, his time and the liquidity available to him. The mass, converted into data, interacts in a specific technological interface, in which informational and emotional dynamics of the most diverse are put into play. It is worth asking what can come out of the mix between Large Language Models (LLMs) and Polymarket.

Within this social framework, the search for profitability has a wide range. Moore et al (2012) argue that even ponzis can be considered as investments, as soon as the actors are aware of the unsustainability of certain projects but bet to arrive early and leave before the system collapses.

Markets of Predictions and Collective Information

I like to think we're the curious, the hunters and the insiders. Recently there was a bet that in 24 hours there was going to be an earthquake above 7 on the Richter scale. I mean, a strong one. Hours later, the Russian earthquake struck, which endangered the coasts of Chile with a possible tsunami. It is impossible to predict an earthquake (unless you think the HAARP project is ticketed for that). But someone may have analyzed public or semi-public information and it was convinced that it was going to happen and soon. In this sense, we can make a conspiratorial reading of this betting market. But there's more.

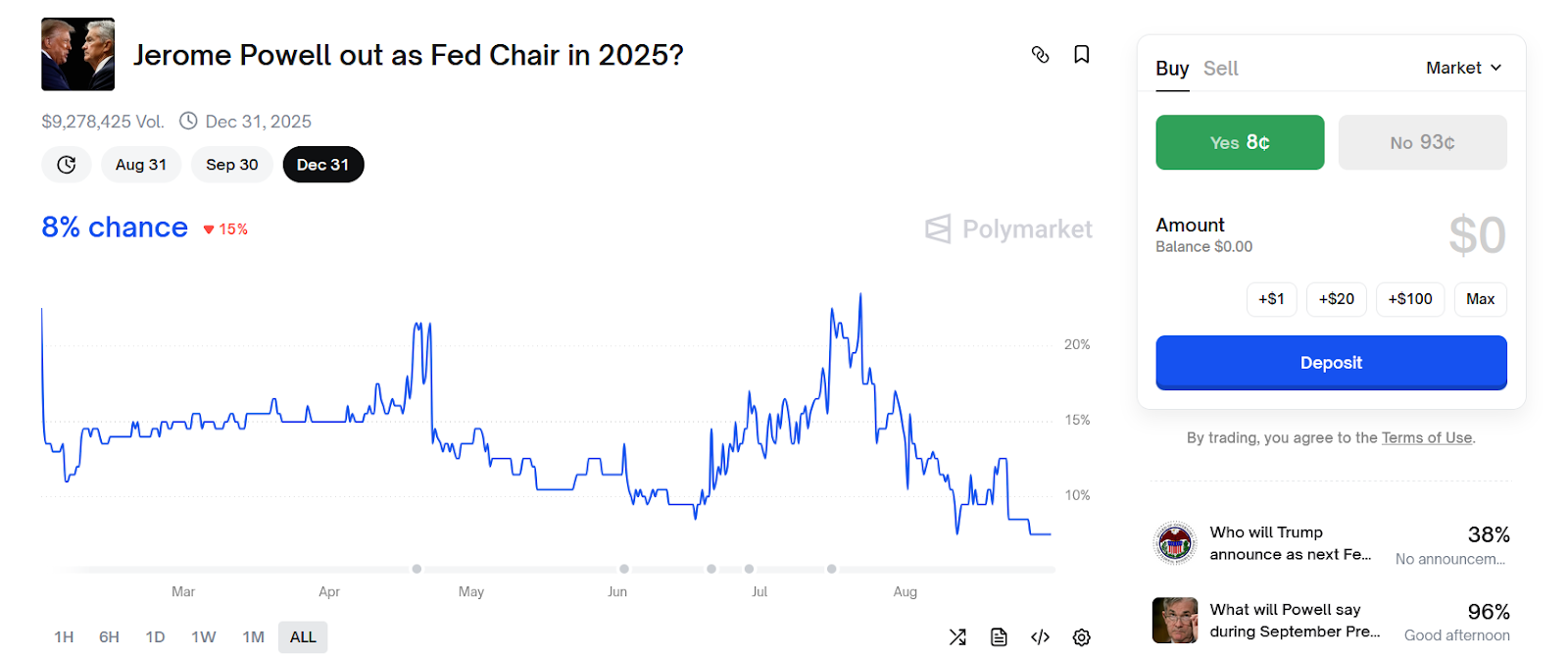

Since Trump’s last election, attention has been drawn to how prediction markets outperformed polls when anticipating results (e.g.). And recently he set himself up great stir in PolymarketPolymarket: an American political backswing could give a shimber to the world economy, in a butterfly effect whose consequences we cannot measure. The possible expulsion of Jerome Powell (president of the American "central bank", the Fed) by Trump was put on a bet and barely enjoys an 8% chance, measures for the market, even under institutional storm.

So far, he's right. But why do prediction markets “predict”? The explanations are quite utilitarian: a survey depends on good faith and predisposition, while a market pays for the most honest, reliable and critical information available to an individual (becaused event trader). That alignment of incentives would bring about collective intelligence.

If we disbelieve for a moment the concept of consciousness, many things resemble intelligence: coordination between insects, trees that do not intermingle their branches, plants that exchange nutrients to help themselves or geometric figurines by putting organisms together in the game of life. But I don't want to get hippie.

Without coming to the idea that all things have soul – rather the opposite: nothing has it – we can think of Polymarket as an interface of collective intelligence. Complex systems in which we aggregate the information that the different agents handle – this is very Hayekian; if I offend, I apologize. Precisely, following the national super-Austrian: how the fuck do we translate all those perspectives (the experts, the bold, the idealists, the memeras) into a single variable? Easy: passing all that information through the sieve of a binary system (yes or no; at most, a few options) and then floating the elements in a price system.

Emerging Intelligence and Government Intelligence

Polymarket is so precise when it comes to measuring the dynamics of public opinion that it is used as a parameter of, for example, on the implications of the policies of the U.S. Executive Power (Trump) on the perceived independence of the Fed. And not only that: these fat Navy propose to use the prediction markets as indices to manage security threats (!). Basically, they propose a framework so that intelligence analysts know how to extract the best possible info from each trade that arises on the platform. Especially where to look.

It is quite striking that they actively propose to seek out for conflict escalation bets that they cannot be seeing. That is, the U.S. Army considers this collective information construct as a relatively reliable source. These indicators would then be contrasted with traditional intelligence methods (OSINT, MASINT, HUMINT, etc.).

Since we're here, this is a little good for all of us. You can be your own intelligence analyst. The military proposes three methods of reading data:

• Cross-information between different bets (which end up putting together an overview). That tensions between two countries rise and at the same time raise the price of a certain good that would indicate the hypothesis of a trade blockade rather than a military escalation.

• Detection of anomalies: threat of terrorist attack in Santiago de Chile, Chinese blockade of Pakistan or North Korean nuclear test on – I do not know – Russia. Fallopa hypothesis to which, suddenly put in a bet, you have to pay attention to. Also, sudden changes in a once consistent bet, such as suddenly there being a slight shift towards the idea that Ukraine will take Moscow.

• Sentiment analysis : here we try to measure the degree of individual confidence and, from there, collective consensus, around a hypothesis. Because it is not the same a collectively consistent bet as a volatile one.

At the same time, that adds another layer of complexity to the subject: Polymarket, thanks to its design, has ingredients to be the scene of intelligence and counterintelligence readings. The disinformation of government agents against information built by the hive-mind of netizens. The latter have the incentive to produce honest and reliable information – because they would win money if they are right – but the former – that is, the CIA – has tons of greens to burn by making fallopa bets that try to destabilize the public opinion landscape. This is a funny hypothesis but not much else. I didn't find documented cases, but there are the ingredients. The point is that the effect could be ephemeral by a regressive effect to the average. We'll see.

Returning to Deleuze and the passage of the lockdown to control, if before the collection of information was locked in the Pentagon building, today it is being carried out collaboratively in the open sky.

Beyond Hayek

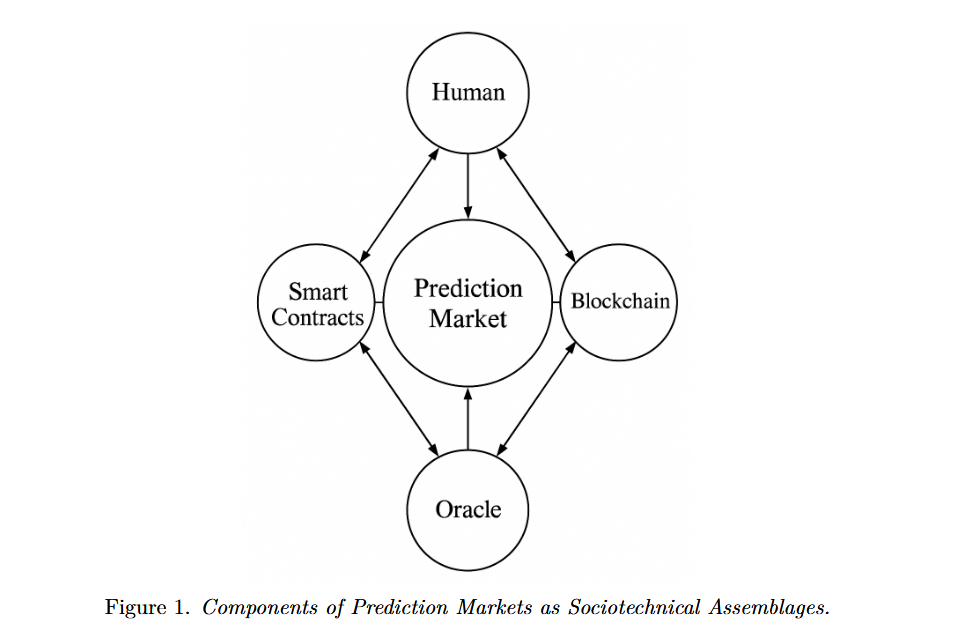

Economist Helen Wu proposes to think of Polymarket not as a neutral space for democratic information aggregation (the Hayekian thesis) but as a sociotechnical assembly with specific sociological and informational structures. That is, it is not a data vaquita: it is the sketch of a Cathedral. Through empirical study, Wu concludes that in each prediction a competition is constituted between specialized traders who are the driver of the information and have disproportionate interference in the formation of prices.

The use of the concept of "assembly" accounts for a post-human instance in Polymarket. The agency is distributed among humans and non-humans, represented by the Automated Market Makers and smart contracts that distribute the guita and mediate between the events of La Vida RealTM and the result accepted by the system. To predict here is not only to predict the future, but also to the one that Polymarket will accept, in times and forms.

High-frequency traders leverage the AMM’s mathematical structure to capture small margins on numerous transactions. Information specialists exploit the blockchain’s transparency to following alternate traders influential. Retail participants provide capital that-inhabitable traders to sophisticated profit from information advantages, creating incentives for informed participation.

At Polymarket, anyone can be an oracle. As a blockchain infrastructure, it allows us, on the one hand, pseudo-anonymity (no one necessarily has names, only figures) but also the monitoring of the trades of each wallet. That way, we have the history of each user. Triangulating that information can even give us intelligence data, as the U.S. military raised in the paper we mentioned earlier. Polymarket opens a bitcoin accessibility paradigm for a market that was born hyper-regulated: the first prediction market was the Iowa Electronics Markets, in the '80s, managed by the university of Iowa, centralized and closed-stake.

We can also ask that Who Watch the Watchmen: the prediction closure model consolidates the elite dynamics that emerges from trades. A trader pays a certain amount and proposes a credible outcome, from which two hours of refutation begins (if someone wants). In case of dispute, the verdict is resolved by consensus among UMA holders, a specific token for this process. In the end, whoever successfully proposes the closure will get the deposit that made the most a reward.

From the ink

Markets are not abstract entities, but material interfaces of communication between very diverse agents (some even non-human, from Wu’s perspective). Banknotes, for example, are a certain type of paper issued by a certain type of institution that is used under certain parameters and situations. It has circulation limitations but traceability advantages, if you will.

Polymarket is an interface with certain characteristics that make it unique: pseudo-anonymity, strong incentives to elaborate complex and informed theses, minimum frictions for the circulation of monetary (money, before, traveled at the speed of horses and ships; the internet gave it the speed of light), traceability of the decisions of users and not so much of the silver that, digitally, is relatively easy to wash, and a system of tokenization that simplifies the Events of the Worldreducir el repertorio de señales The guita circulates, the information circulates, no identities and no central regulators circulate.

There have been legends within Polymarket, such as the French Théo, who raised 85 million dollars (!) with the bet on the US election. The epic of the nick and the hacker’s ethics seem to emerge, sometimes, among the rubble left behind by technological oligopolies.

Managing the future in an open and decentralized way still has consequences to show. Agents covering their own bankruptcies. Politicians charging for actions they will take. The standardization of triangulations between different predictions that in the end facilitate the real-time monitoring of boundary situations such as wars. Light does not behave in the same way whether it is observed or not. Why human action would do it.

Polymarket is to operate a 5D chess. The timelines intersect and we will no longer know if we are at all in the present. If we will be completely in the future.